Started in a Brisbane garage, now helping businesses across Australia think differently about their money

We didn't set out to revolutionize anything. Just wanted to help business owners stop making emotional decisions with their capital. Turns out, that was harder than expected.

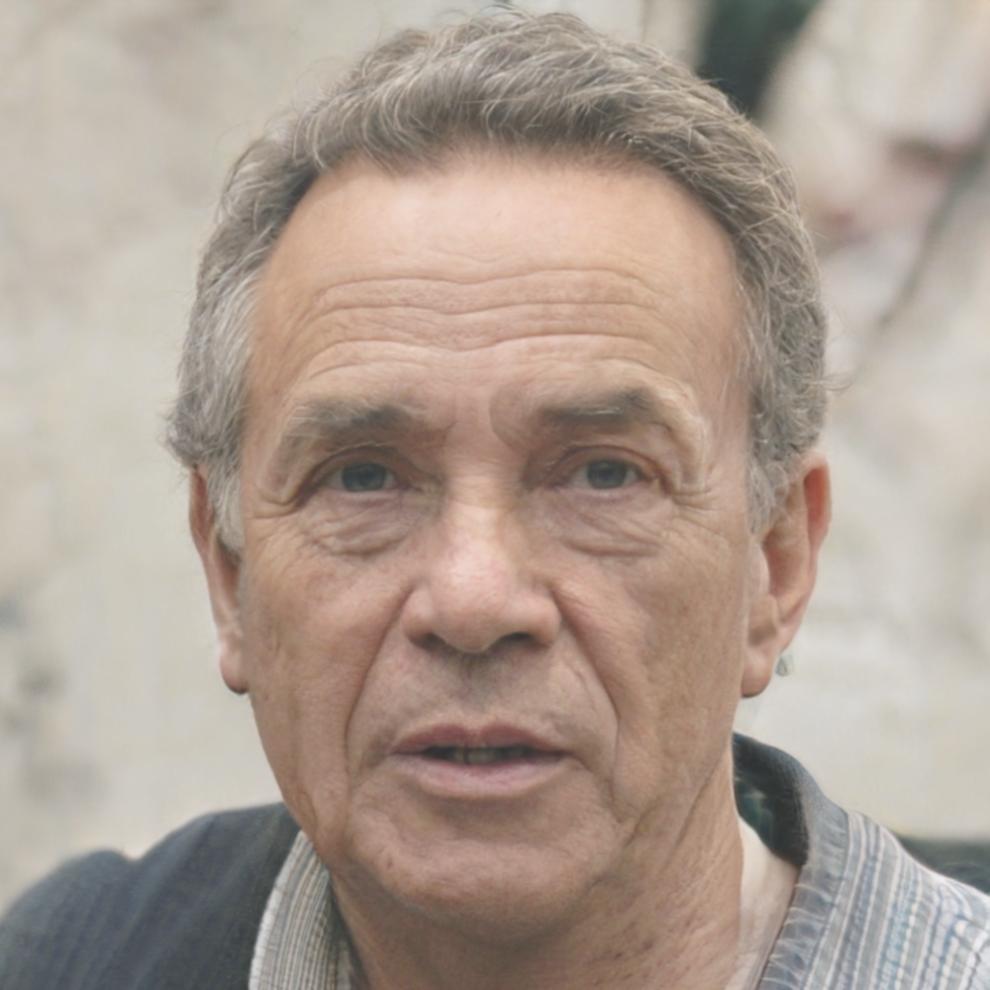

Fletcher Drummond left corporate finance after watching too many SMEs make avoidable mistakes. Started with three clients and a second-hand desk. The goal was simple: help business owners understand where their money actually goes.

When everything shut down, we shifted to remote advisory. Built our first decision framework that helped seventeen businesses restructure without panic. Learned more in six months than the previous two years.

Moved into proper offices on Egert Court. Added two analysts who actually understand Queensland's small business landscape. Started focusing exclusively on capital allocation—stopped trying to be everything to everyone.

Working with fifty-two businesses now. Refined our approach to three core areas: resource allocation, growth funding, and risk management. Not where we imagined, but exactly where we need to be.

Founder & Principal Advisor

Spent twelve years in institutional finance before realizing I was better at translating complex financial concepts than implementing them at scale. Brisbane born, studied at QUT, worked in Sydney for a bit—but came back because this is home.

Most rewarding part? Watching a business owner's face when they finally understand their cash flow isn't a mystery. Second most rewarding? My coffee habit is now tax-deductible.

No fancy jargon or proprietary systems. Just three straightforward steps we've refined since 2018. Works for retail shops, tech startups, and everything in between.

We sit down and figure out where your money actually goes. Not where you think it goes—where it really goes. Takes about two weeks of data gathering and honest conversations.

Create a decision-making structure that matches how you think. Some clients need spreadsheets, others prefer visual dashboards. Point is making it useful, not impressive.

Roll out changes gradually. Check in quarterly to see what's working and what isn't. Most frameworks need tweaking in the first six months—that's normal, not failure.

Not planning to become the biggest firm in Brisbane. More interested in getting really good at what we do. By late 2026, we want to have refined our methodology to the point where any business owner can implement basic capital allocation principles without us.

Sounds counterintuitive for a consultancy, but we'd rather work with clients who genuinely need strategic guidance than those who just need someone to organize their spreadsheets.

Also working on some educational resources for business owners who aren't ready for advisory services yet. Thinking workshops starting autumn 2026, maybe some practical guides before that. We'll see how it goes.

Talk About Your Business